Rising prices cut into incomes

Updated: 2011-09-27 09:22

By Bao Chang (China Daily)

|

|||||||||||

|

Chinese customers examining gold products in front of a gold and jewelry counter at a department store in Beijing. As inflationary pressure is mounting, an increasing number of Chinese are investing in gold, stocks and real estate to boost their wealth or protect their assets. [Photo/China Daily] |

| ?

|

BEIJING - "Do you want to buy some gold for spot trading?" came the call for the third time in a week to Wang Xiaojie, who works for a State-owned bank in Beijing Financial Street.

The street that lies under the shadow of dense skyscrapers housing a multitude of domestic and foreign financial institutions is currently flooded with gung-ho gold salesmen, as bustling as the nearby shopping center, although the market for the yellow metal has been suffering hits recently.

International spot gold prices suffered the largest two-day drop last month, declining by $148.50 from an all-time high of $1,911.46 a troy ounce on Aug 22. They have been up and down ever since.

"The setback is inevitable but it is still too early to call the top of a bull market in gold and the arguments for buying have never been stronger," the UK's Financial Times cited British investor Jim Slater as saying. He added that the Chinese government has been encouraging its population to buy gold. The current exchange-traded funds and very low interest rates are making it much easier and less costly for private investors to own the precious commodity.

People's strong enthusiasm for investing in gold, stock and real estate markets have demonstrated that they are keen to increase their incomes against a backdrop of high inflation.

Driven by robust market demand, the price of commodities has grown at a fast pace this year. On Sept 15, HSBC lifted its 2012 gold price forecast to $2,025 an ounce from a previous $1,625. Gold Fields Mineral Services Ltd (GFMS), a London-based independent precious metals consultancy, said it could "easily" see gold spiking through $2,000 an ounce by the end of this year.

The price of diamonds has increased by more than 30 percent in the Chinese market after being marked up eight times internationally this year.

"Diamonds are also embracing a wave of enthusiasm from private investors as inflation remains high, the stock market fluctuates and investment in the real estate market is limited," said Tang Jiarui, a retail analyst at Everbright Securities Co Ltd.

"China's full-year inflation might exceed the country's 2011 full year target of 4 percent, judging from the current trend", said Zhang Xiaoqiang, deputy chief of the National Development and Reform Commission, during the Summer Davos held in Dalian from Sept 14 to 16.

Zhang said 4 percent was the country's previous prediction for the full year but it could be exceeded, judging from the current situation.

China's consumer price index (CPI), a main gauge of inflation, eased to 6.2 percent year-on-year in August, from 6.5 percent in July, according to the National Bureau of Statistics (NBS).

"Chinese people who used to put most of their yearly savings in their bank accounts will see their private assets suffering a rapid decline because the inflation rate is higher than banks' time-deposit rate. In other words, it is a negative-interest environment," said Liang Da, from the NBS.

The People's Bank of China, the central bank, raised bank's benchmark one-year borrowing and lending rates by 25 basis points in July, making it clear that taming inflation remains a top priority even as economic growth eases.

It's the third time the central bank raised interest rates this year. The move increased the benchmark one-year deposit rate to 3.5 percent.

However, compared with the CPI in August, the negative interest rate is 2.7 percent.

"The current situation has made it very difficult for Chinese citizens to preserve the value of their assets. The income they could generate from bank deposits is extremely limited," Liang said.

"However, income from assets will increase rapidly in the future as wages increase, the financial industry develops and people become more familiar with investment portfolios," Liang added.

Currently, the investment channels in China mainly include stocks, foreign currency, real estate and commodities including gold.

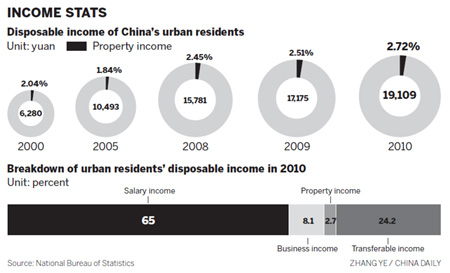

Income from Chinese people's assets presently accounts for little more than 2 percent of the total per capita disposable income, while the ratio for payroll income is about 65 percent.

"Income from assets is expected to experience fast growth and involve diverse sources in China because people will have enough assets and ability to invest and withstand market risks," Liang said.

Statistics from the People's Bank of China show that the savings deposits of China's urban residents now amount to 30.3 trillion yuan ($4.73 trillion) in total, with each person on average possessing 23,000 yuan by the end of 2010.

Premier Wen Jiabao said during this month's Dalian Davos that the per capita disposable income in real terms for both urban and rural residents has risen more than 7 percent over the past year. He added the government will continue to increase incomes along with the growth of the national revenue in a move to synchronize the development of both residents and the nation's wealth.