Nervy politicians, unsure voters and wary investors

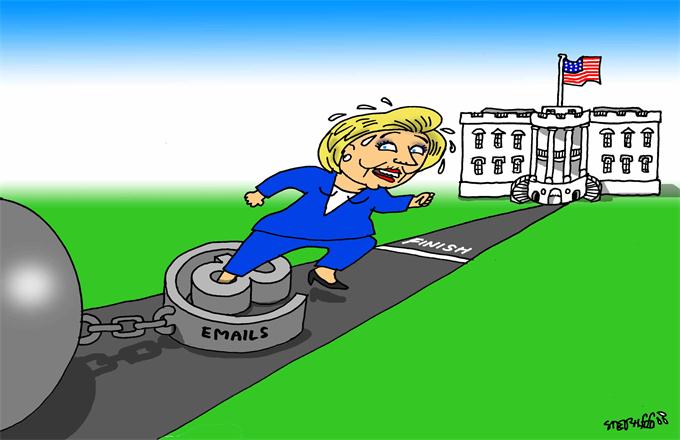

It was never meant to be a close call. If anything, this American election was expected to be more a coronation than a contest. Except opinion polls conducted over the weekend and throughout the past week show Donald Trump scrambling back into electoral contention. While his Democratic opponent and her supporters maintain an air of outer calm, there's no doubt they are worried. And they are not the only ones. Fears of a Trump victory on Tuesday have gripped wary investors and pushed back against a rising dollar. Traditional currency and bullion safe havens have strengthened in recent days and are expected to continue their upward climb through Election Day. This inhibits an otherwise resurgent greenback and threatens to reverse gains made on the back of a weak Euro, volatile Pound and bullish Fed. Worst case, a continued decline in the US currency could potentially imperil an anticipated interest rate hike this December.

Much like the Yen and the Franc, Gold has also gained as a result of the tightening race. In the previous week alone, it crossed the $1,300 mark. Market analysts now warn of a climb to $1,400 in the event of a Trump win and a decline of $20 to $30 if Hillary Clinton is able to stave off his challenge. While it has an outsized impact on the price of the bullion, the American electorate is not alone in driving gold prices. A weak Yuan and recent restrictions on real estate speculation in China also have a part to play. In an effort to diversify, Chinese investors have increased their holdings of the bullion. In fact, shipments of gold from Switzerland to China in the month of October equaled 35.5 tons—a sharp increase from the previous monthly total of 19.9 tons.

While dollar and gold prices have fluctuated in the recent past, crude oil appears stuck in a rut. Hamstrung by chronic excess in inventory, crude closed at $46.35 a barrel this past week. The bearish trend was only to be expected; OPEC efforts to cut production have proved decidedly futile. If anything, falling revenues in many member states have resulted in higher than normal production rates. Saudi Arabia, Libya, Nigeria and Angola have all dialed up production in recent months while Iran and Iraq have already signaled an unwillingness to freeze, let alone cut back on production. There is little hope then of non-OPEC members reducing output. Declining investment in upstream oil and gas exploration is perhaps the best indication of an industry pessimistic about its short term future.

A flailing dollar may have complicated the outlook for American capital markets but it has bolstered the Renminbi—and market analysts anticipate a more favorable environment for both the Chinese economy and its currency later this year. Despite fears of an impending slowdown, GDP grew at a rate of 7% from March to August. Bloomberg reports indicate rising Purchasing Manager Indices, increased profit taking for industrial enterprises, and a more robust demand for iron ore and copper (traditionally the fuel for Chinese infrastructure expansion).

So in the days and weeks ahead, the PBOC will have to balance the benefit of a growing economy against the inherent risk of speculative investments and asset bubbles. After the stock market collapse last year, policymakers are by all accounts likely to tread nothing but a conservative path to growth. But before any of that becomes front page news, all attention here in Asia and indeed throughout the world remains firmly and unflinchingly on the American Presidential Election—and well it should.

The writer is a freelance contributor with an interest in global markets and geopolitics.