The consensus is that the price of gold will, at best, grind lower this year, as the support from loose US monetary policy gradually weakens. In contrast, with investor sentiment already heavily negative, our (Capital Economics') view is that the risks for the coming year are firmly skewed to the upside.

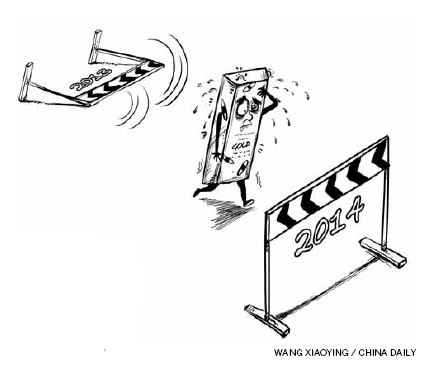

Looking back, 2013 was indeed a disappointing year for the price of gold. But since the first half was much worse than the second, it suggests the worst of the slump may be over. Between January and June, the price of gold dived from about $1,675 to less than $1,200 an ounce. In the second half, gold staged a partial recovery, rising to the $1,400 level, before dropping back to and finding some support at $1,200 again.

Admittedly, we had expected a much better performance. At the beginning of 2013, our forecast was that gold would rebound to a record high of $2,200 by the end of the year, helped by a renewed escalation of the eurozone crisis. We had anticipated some weakness as the US Federal Reserve gradually scaled back its asset purchases, but still thought gold would hold up well.

In the event, pretty much everything that could go wrong did go wrong, for gold, that is. First, our fears that the eurozone crisis would re-escalate in 2013 proved unfounded thanks in part to the continued calming influence of the European Central Bank. What's more, when problems worsened in Cyprus, the threat of gold sales to finance the bailouts for banks further undermined sentiments toward the precious metal.

Second, the gold market initially reacted more negatively than expected to the Fed's move to the end quantitative easing. The combination of rising real yields and fading inflation fears has proved a toxic mix. The strength of the US economic recovery has also maintained confidence in the dollar despite another round of brinkmanship in Congress over the debt ceiling.

Third, the strong performance of equities in developed markets has made it hard to make a compelling investment case for gold. Huge outflows from gold exchange-traded funds have dominated the headlines for much of the year. The demand from households and central banks in emerging economies has been relatively resilient, but sales in India have been hit hard by import restrictions.

The consensus is that these factors will undermine the price of gold further in 2014. Indeed, other headwinds may build. The swing from central banks selling to buying could be complete. Producers are reportedly starting to sell their output in the futures market to lock in prices that are still historically high.

But taking each of these factors in turn, we think that the balance of risks to prices lies on the upside. The eurozone's fundamental problems have still not been fixed and another difficult year lies ahead. Deflation is also a growing threat. The conventional wisdom is that deflation is negative for the price of gold, but in the context of the eurozone it may simply exacerbate the debt problems of the weaker economies and force the ECB to loosen monetary policy further. And if pushed to the edge, governments seem far more likely to default than to sell the nations' gold reserves.

Also, the Fed has announced the first, small reduction in its asset purchases, removing one uncertainty hanging over the market. US monetary expansion is likely to continue through most, if not all, of 2014, and US interest rates are set to remain low for a significantly longer time. Other globally important central banks will also keep their policies loose, or even ease them further, led by Bank of Japan.

Finally, demand from emerging economies should pick up again. Restrictions on the Indian market are likely to be lifted this year, which is one of several potential catalysts for a rebound in prices. Producer hedging may be a negative but prices have already fallen to levels that are not far above marginal costs, raising the prospect of a shortage of newly mined supply.

Overall, we see plenty of scope for gold to bounce back this year. Indeed, the poor performance in 2013 has left the precious metal looking attractive again compared to other assets, including equities. The bursting of the Bitcoin bubble may even make gold look more appealing to Chinese investors. We will review all our commodity forecasts, but now we are happy to reiterate that the price of gold will revisit $1,400 this year, and probably go higher.

The author is head of commodities research at Capital Economics, a leading independent macroeconomics research company.