Black market capital

"The central government has urged large banks to support small and medium-sized enterprises for many years, but has achieved minimal results. In the end, the government has no choice but to support private banks," said Jin.

"Today, as the Chinese economy continues to slow, banks do not lack customers. As long as the banks have low-risk, high-profit projects associated with the government, there is no reason for them to invest in small and medium-sized enterprises that are likely to bring problems," he added.

Even if some State-owned and State-held banks are willing to provide loans to SMEs, they usually set the bar higher. China Everbright Bank, for example, defines SMEs as companies with registered capital of at least 5 million yuan and annual sales in excess of 20 million yuan. According to those criteria, only 3 percent of 100,000 private enterprises in the Nanhai district of Foshan, Guangdong province, are qualified to apply for a loan from China Everbright. And only 10 to 15 percent of those 3,000 companies will eventually obtain the loans they seek, said Lang.

As a result, more than 90 percent of China's private businesses are forced to rely on black market capital, at usurious rates of interest, even though 80 percent of new jobs are created by private companies, he said.

A central bank investigation found that private lending had hit 3.38 trillion yuan nationwide by May 2011, and the average interest rate was 15.6 percent.

In Wenzhou, a world leader in light manufacturing, in Zhejiang province, private lending totaled 110 billion yuan by July 2011, with an annual interest rate of 24.4 percent. Around 59 percent of businesses and 89 percent of families and individuals in the city were involved in private lending in some capacity, according to the local branch of the People's Bank of China.

"If the bar is too high for private capital to enter the financial market, it will find secret ways to invest and will fall out of government supervision. But private banks would bring these underground financial activities out into the sunlight by providing a legal channel for investment. That would also strengthen risk prevention," said Lei Wei, a financial researcher with the Development Research Center of the State Council.

The growth of small and medium-sized banks, especially private banks, lags far behind the growing demand. By the end of 2012, China had more than 1,400 small and medium-sized banks, including city commercial banks and village banks, but their assets accounted for just 15 percent of total bank assets nationwide, wrote Ji Zhihong, director of the central bank's research bureau, in an article published in Caijing Magazine on June 20.

According to Yang of CASS, "Promoting the development of private banks will increase competition in the financial market and improve the overall quality of financial services. Private banks have significant advantages over their State-owned counterparts in terms of market efficiency, management systems, property rights arrangements, transaction costs and ability to innovate. Accelerating the entry of private capital into the banking industry will spur continual reform of State-held financial institutions."

Wu Qing, a financial researcher with the State Council's Development Research Center, said: "By setting up private banks, China will introduce a new type of institution to the financial system. We hope they will have a different way of doing business and offer different financial products and services.

"For example, Suning's rich retail experience means that it understands the types of financial services retailers require far better than any bank. If the government gives it a banking license, the company will provide good services for itself and similar businesses," he said.

"However, the government is only conducting an experiment. Private banks will only account for a tiny proportion of the Chinese banking system. We can't expect them to challenge the existing system or change the banking industry overnight. China's banking industry will not achieve overall progress until the government loosens the regulations so that all the banks compete in the provision of new services."

Contact the writer at [email protected]

World's first 1-liter car debuts in Beijing

World's first 1-liter car debuts in Beijing

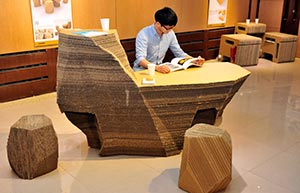

Paper-made furniture lights up art show

Paper-made furniture lights up art show

Robots kick off football match in Hefei

Robots kick off football match in Hefei

Aerobatic team prepare for Aviation Convention

Aerobatic team prepare for Aviation Convention

China Suzhou Electronic Manufacturer Exposition kicks off

China Suzhou Electronic Manufacturer Exposition kicks off

'Squid beauty' and her profitable BBQ store

'Squid beauty' and her profitable BBQ store

A day in the life of a car model

A day in the life of a car model

Vintage cars gather in downtown Beijing

Vintage cars gather in downtown Beijing