Top Biz News

Lenders' share sale rumor sparks sell-off on bourses

(China Daily/Agencies)

Updated: 2009-11-27 08:02

|

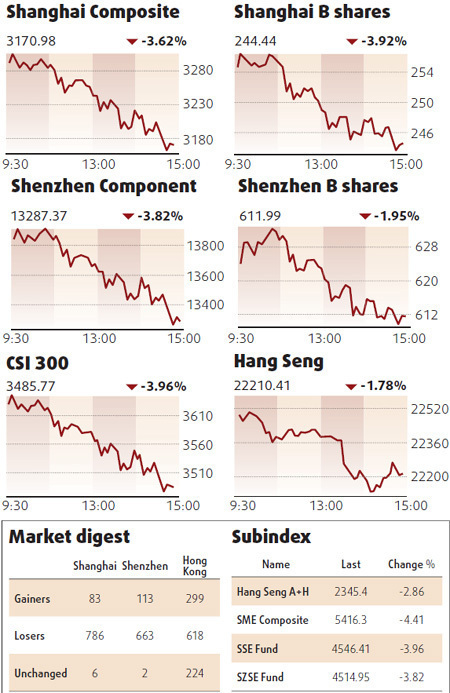

The Shanghai Composite Index fell 3.6 percent yesterday. [Getty Images] |

Chinese stocks slumped, driving the benchmark index to its biggest drop in almost three months, on concern banks will sell more shares to meet swelling loan demand.

"I don't think Chinese banks need to raise capital but I'm not risking it," said Roger Groebli, Singapore-based head of financial market analysis at LGT Capital Management. "Investors are selling to avoid volatility until the picture becomes clearer."

The Shanghai Composite Index lost 119.19, or 3.6 percent, to 3170.98 at the close, the biggest drop since Aug 31. The gauge plunged 3.5 percent on Nov 24 on concern banks will sell shares, before rebounding 2.1 percent yesterday.

Bank of China, the country's third-biggest lender, dropped 3.5 percent to 4.13 yuan, the most since Aug 31. Industrial & Commercial Bank of China Ltd, the largest, slipped 2.8 percent to 5.18 yuan. China Construction Bank Corp, the No 2, sank 3.4 percent to 5.92 yuan.

Minsheng slumped 5.6 percent to 7.89 yuan as it became the first Chinese lender in four years to fall on its debut in Hong Kong listing, where its shares slid 3 percent.

The company this month raised HK$30.1 billion in the city's biggest public share sale since April 2007.

Haitong Securities, one of the managers of Minsheng's share sale, tumbled 5.8 percent to 15.17 yuan. Other brokerages also fell. CITIC Securities Co, the nation's largest by market value, slumped 5.7 percent to 28.29 yuan, its biggest drop since Aug 31.

An index tracking 50 financial companies on the CSI 300 declined 4.2 percent, accounting for almost half the losses on the main gauge. All 10 industry groups declined.

Baoshan Iron & Steel Co, the nation's biggest steelmaker, lost 6.6 percent to 8.34 yuan after rallying 31 percent this month. PetroChina Co, the nation's largest oil company, slipped 3 percent to 13.39 yuan. SAIC Motor Co, the No 1 automaker, declined 5.3 percent to 23.72 yuan. The stock's more than quadrupled this year.

Investors opened 365,539 accounts to trade China stocks in the week ending Nov 20, the most since Sept 4 and a sixth weekly increase, according to the nation's clearing house.