|

|

|

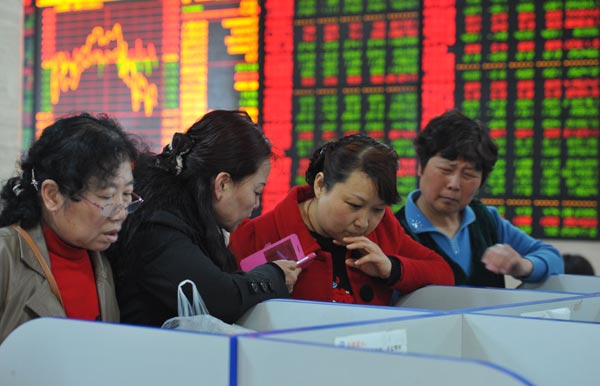

Investors at a securities firm in Fuyang, Anhui province, on Monday. Turnover of the Shanghai Stock Exchange hit a record, at more than 1.14 trillion yuan ($183.8 billion). [Photo/China Daily] |

Shanghai drops 1.64% and Hong Kong falls 2.16% as regulators leave markets on edge

Markets in Shanghai and Hong Kong had a roller coaster ride on Monday as investors struggled to get to grips with the intentions of the central bank and securities regulator.

The People's Bank of China decided to cut the amount of cash that lenders must hold as required reserve by 1 percentage point on Sunday. It was the second industry-wide cut in two months and the largest since November 2008. The decision will release liquidity of at least 1.2 trillion yuan ($194 billion) to boost economic growth.

"Over the weekend, regulators gave the market both sticks and carrots, emboldening both bulls and bears," Qilu Securities Co wrote in a note to clients.

Even so, the market news was mixed. The benchmark Shanghai Composite Index slumped by 1.64 percent to 4,217.08 points after climbing by 1 percent in morning trading.

This was the biggest loss in almost seven weeks, but turnover still hit a record when it surpassed 1.14 trillion yuan at the close.

In Hong Kong, investors were also cautious as they tried to work out mixed messages from authorities on the Chinese mainland during the weekend. The benchmark Hang Seng Index plunged 2.16 percent to 27,057.13, with turnover surpassing HK$211 billion ($27.4 billion).

Two of the big losers were CNR Corp and CSR Corp. The train manufacturers and rolling stock companies both lost more than 10 percent in Hong Kong, paring gains this year to about 70 percent. CITIC Securities Co and Haitong Securities Corp also had bumpy rides, dropping 7 percent after the China Securities Regulatory Commission tightened rules on margin trading.

Analysts fear that the bull run may be running out of steam after the securities watchdog curbed margin lending on Friday. This in turn could squeeze liquidity.

As for the decision on Sunday by the PBOC to lower the reserve requirement ratio, analysts said that this had been largely priced into the market by investors.

"For example, following the reserve requirement ratio cut, an interest rate cut is already within expectation," said Hong Hao, chief China strategist at Bocom International Holdings Co in Hong Kong. But even that might not be enough as Hong said that the market was looking for something out of the ordinary to boost share prices.

Moves by the central authorities at the weekend "effectively" showed the government "wants" stocks to go up. "But even though the regulator reiterated a 'slow bull' is preferred to a 'fast bull', Chinese speculators can only understand the word 'bull', and in China, nothing happens slowly," Hong wrote in a research note on Monday.

For many investors, these have been difficult days. On Friday, the CSRC emphasized its plan to clamp down on irrational margin lending. This was immediately taken by analysts as a "bearish" signal from the authority.

The offshore Chinese equity-index futures fell as much as 6.3 percent before erasing most of those declines after the CSRC made it clear the move was not made to curb stock markets. Then on Sunday, the central bank announced the biggest reserve ratio trim since 2008.

Although some investors have expressed concern about the Shanghai capital market overheating, others are still bullish.

"My stock account is full. I am optimistic that the correction is temporary," said Eric Wu, an individual investor in Shanghai.

Wu is not alone in his view. "We are taking profit in four stocks from our equity model portfolio, thus raising the level of cash from zero to 10 percent. This is a tactical move, however, and does not change our full-year and three-year bullish view on the MSCI-China," Wendy Liu and other researchers with Nomura Securities Co said in a report on Monday.