New policies need to account for repercussions of external reflation

Since the US Federal Reserve cut the federal funds rate in September by a larger-than-expected 50 basis points, the market is expecting more rate cuts. However, recent data released by the United States showed that jobs in its nonagricultural sector increased by 254,000 in September, far exceeding the expected 150,000. Thus US unemployment rate dropped to 4.1 percent in September, below the expected 4.2 percent.

Driven by the surge in orders and strengthening business activity, the US ISM services PMI stood at 54.9 in September, much higher than the expected 51.7, the third consecutive month of expansion. A series of US data in September far exceeded market expectations leading to a sharp reversal of rate cut expectations, resulting in short-selling of the yen and euro at the global exchange market, and also the interruption of the recent appreciation of the renminbi.

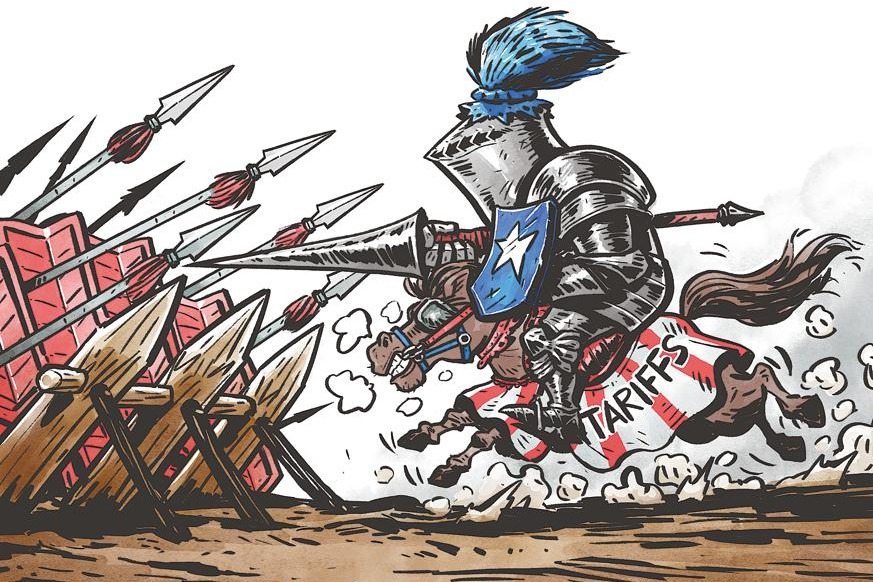

Correspondingly, there have emerged concerns about reflation in the US, also because of the uncertainty involving the presidential elections. This will interrupt the pace of the Fed's rate cuts. If the new president supports the policy of a strong dollar, or imposes a 20 percent tariff on all US imports, it will put inflationary pressure on the US that mainly relies on imported consumer goods.

The strengthening of the US dollar brought about by the current reflation expectation may produce some external effects on a series of incremental policies recently introduced by China, such as causing temporary depreciation of the RMB exchange rate. However, the US economy does not support sustained high interest rates, especially as interest payments on the US' federal debt will be as high as $892 billion this year.

The main problem facing China's economy is the lack of effective domestic demand, but China's exports still remain internationally competitive. Therefore, what China should do next is to implement a package of incremental policies and actively expand domestic demand.

As the US economy enters a soft landing process and China starts to implement a package of incremental policies, the impact of US factors on China's economy may be reduced under the two different cycles. It is believed that with the orderly and gradual strengthening of its incremental policies, China's economy will be on the track of sustained recovery. China's systematic and gradual fortification of policy intensity will avoid irrational fluctuations caused by speculative sentiment, consolidating its economic growth foundation and improving growth quality.