China's hedge against geopolitical shock

In terms of geopolitical impact, nothing could be more important than the United States' shift from strategic cooperation to strategic competition with China. This change has darkened many observers' views of China's economic prospects, as indicated by a Bruegel report released late last year.

The assumption, it seems, is that China has no choice but to retreat from its successful development path and embark on a less prosperous path toward self-reliance, with the State exercising complete control over the economy to hedge against geopolitical shocks. But China's efforts to bolster its self-sufficiency in some areas are a reasonable response to external pressures-and they hardly spell doom for its economic model or prospects.

In recent years, the US has ramped up its effort to "contain" China's rise. Beyond employing tariff and non-tariff barriers on imports from China, it has been limiting Chinese investment by, among other things, blocking Chinese enterprises from acquiring companies in some high-tech sectors in the US. It has also continued to add Chinese enterprises to its so-called Entity List, thereby restricting their access to US-controlled critical technologies such as semiconductors, barred US capital from entering some of China's strategic industries, and forced Chinese companies off US stock exchanges.

As my co-author, Shuo Shi, and I show in a 2020 paper, these policies could only carry escalating strategic costs for the US. And, contrary to popular belief, their lasting impact on the Chinese economy could be very limited, let alone being enough to check China's economic rise.

More important, China has already crossed a crucial threshold in terms of technological strength as measured by the stock value of physical- and human-capital accumulation. It is now only a matter of when, not if, China will catch up with the US technologically.

Chinese leaders have been clear that the country must move faster toward global technological parity to better mitigate the risks from the geopolitical impact. In recent years, the government has increased spending to strengthen China's capabilities in basic and strategic sectors, including education, science and technology, agriculture, and renewable energy. It has also implemented policies aimed at supporting the rapid development of cutting-edge high-tech industries, such as big data, cloud computing, 5G, and artificial intelligence.

Similarly, in accordance with its five-year plans, China has been expanding its digital infrastructure system. According to China's Ministry of Industry and Information Technology, the country has already established 1.4 million 5G base stations-more than 60 percent of the world's total-with over 650,000 built last year alone.

Such efforts are largely a response to the endogenous need to shift to a more advanced stage of economic development, not simply a response to US containment policies and geopolitical shocks. Given this imperative, perhaps the greatest impact of the US efforts to contain China has been the coming to light of China's weaknesses and the additional efforts to address them.

Chinese authorities do not believe the US containment policies will force China out of the existing global economic system, let alone lead it to embrace an inward-looking, State-controlled development model. Predictions that US policies will have such an effect underestimate the competitiveness gains that have driven China's economic rise over the past few decades and the profound impact it has had on the global economy.

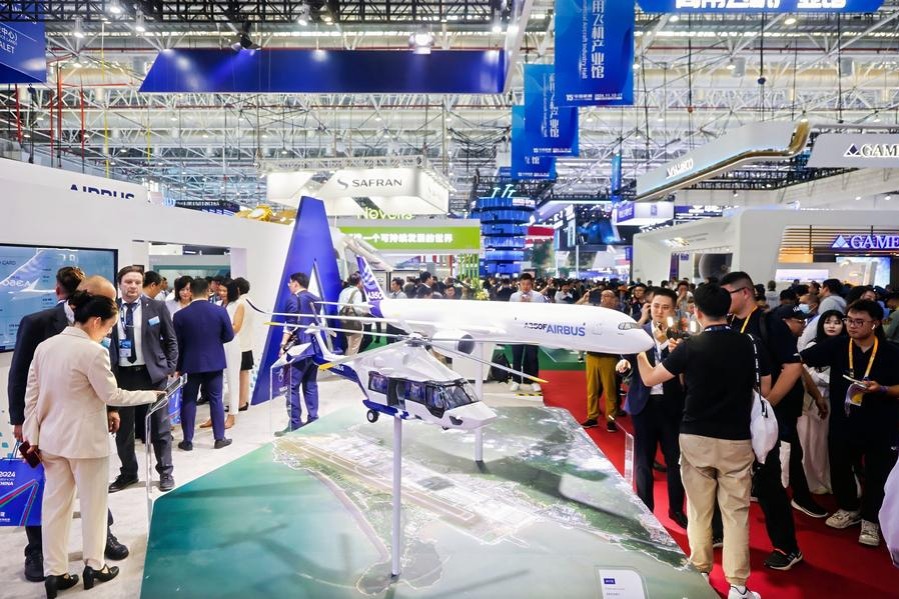

As the world's second-largest economy, China has accumulated vast physical and human capital. It is also deeply embedded in, and central to, global production, and has formed complementary relationships with advanced economies. China is thus highly unlikely to be pushed out of the global supply chains in any comprehensive way.

In fact, even as China has sought to build resilience at home, it has continued to pursue economic liberalization, such as by improving its business climate, creating a more open financial sector, and establishing many more free trade zones. Also, the government remains committed to liberalizing the domestic market in order to maintain its linkage with international markets.

As such, setting aside geopolitical challenges, China must confront its own domestic issues, beginning with the falling fertility rate, especially because despite the easing of the overly restrictive fertility policies, the country's fertility rate may continue to decline judging by the demographic trend in East Asia.

To stem the decline of the working-age population, China is likely to raise the retirement age soon. At the same time, to hedge against the impact of population aging on future economic growth, it will continue to increase investment in education, thereby upgrading workers' skills and raising labor productivity in the long term.

To increase and realize the economy's growth potential, China needs to urgently commit to productivity-enhancing structural reforms. Here, China should draw lessons from the East Asian economies, where a slowdown in total factor productivity growth has almost always followed a period of high growth. One such lesson is to resist political pressure to allocate resources to less productive regions. Another is to avoid capital overinvestment in areas such as real estate, which do not contribute much to productivity growth and instead cause macroeconomic instability.

That is why the government must pursue challenging structural reforms that can correct resource misallocation and enable productivity growth, the scope for which remains large. For example, China should open up more of its economy to private capital, which in turn would help to channel additional resources toward more productive, entrepreneurial sectors that will use them more efficiently and creatively than State-owned enterprises.

China's growth and productivity potential is yet to be fully tapped, and US' containment policy and geopolitical shocks will not stop that. But, in order to realize its potential, China must accelerate its structural reform efforts, as it did in the late 1990s, and improve the allocation of resources by fostering a more equitable, competitive, and market-oriented system.

Project Syndicate

The views don't necessarily reflect those of China Daily.

The author is the dean of the School of Economics at Fudan University, and director of the China Center for Economic Studies, a Shanghai-based think tank.

If you have a specific expertise, or would like to share your thought about our stories, then send us your writings at opinion@chinadaily.com.cn, and comment@chinadaily.com.cn.

- Free-fall

- Someone has to stand up and say 'NO'

- Past 50 years offer guide to future of relationship

- Rwanda's containment of Marburg Virus an exemplary partnership in action

- Opportunity for Beijing and Brussels to enhance mutual trust, consolidate partnership: China Daily editorial